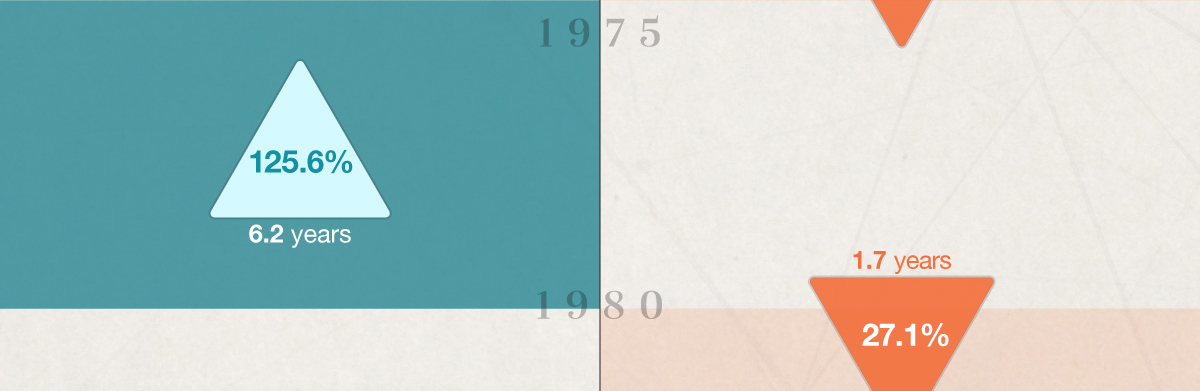

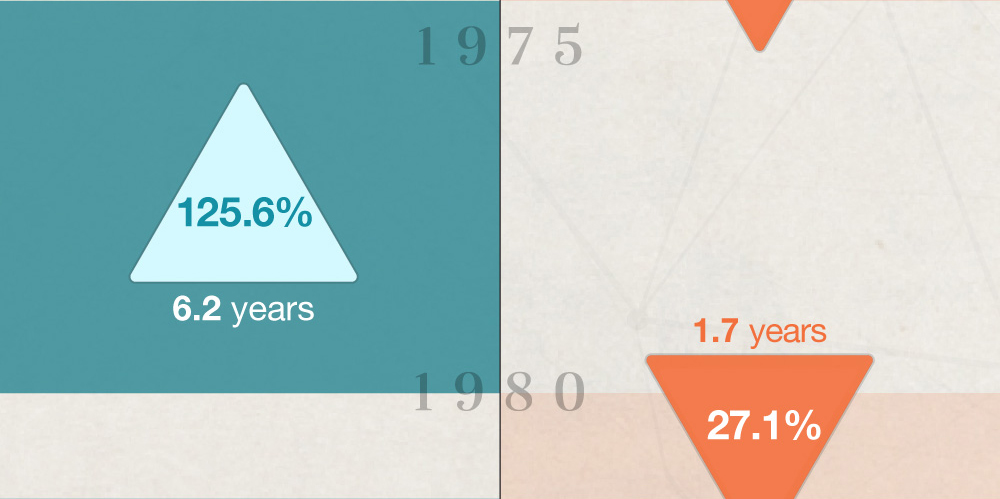

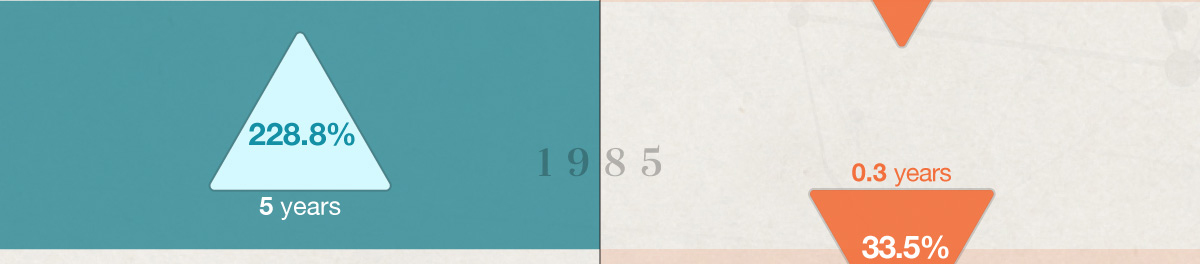

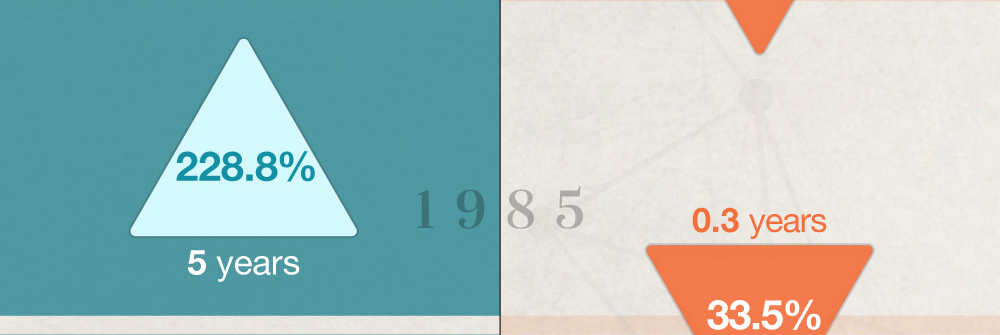

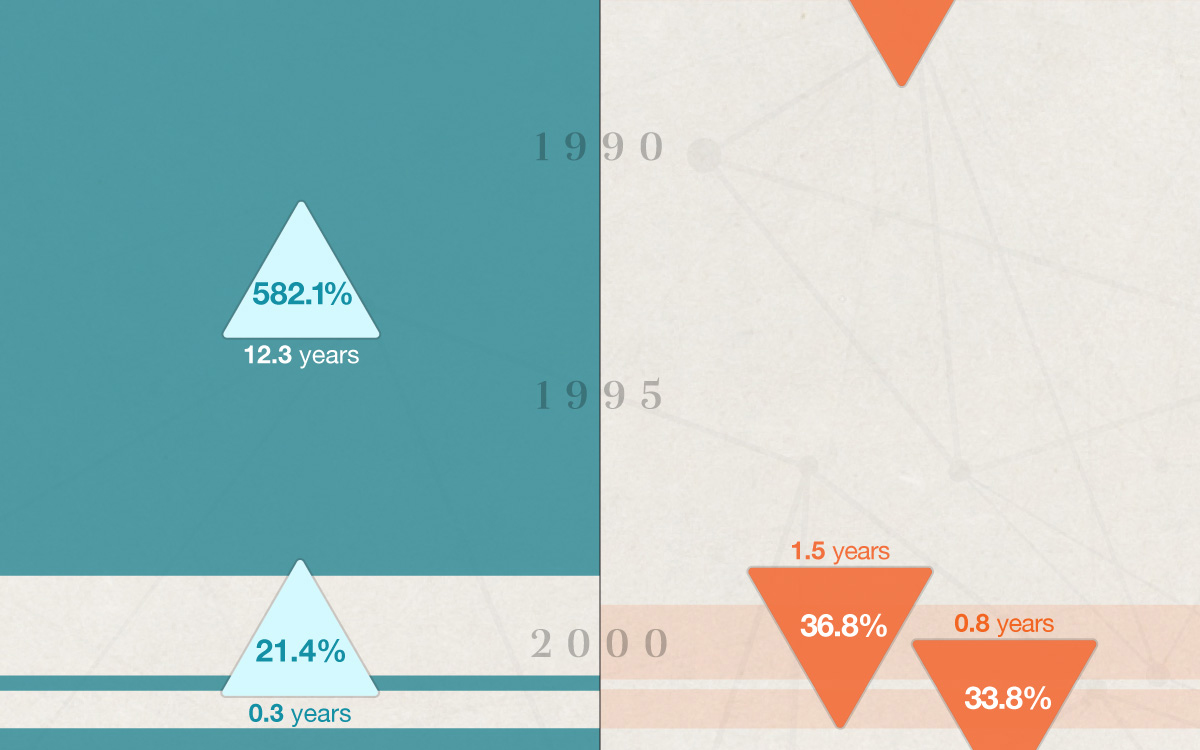

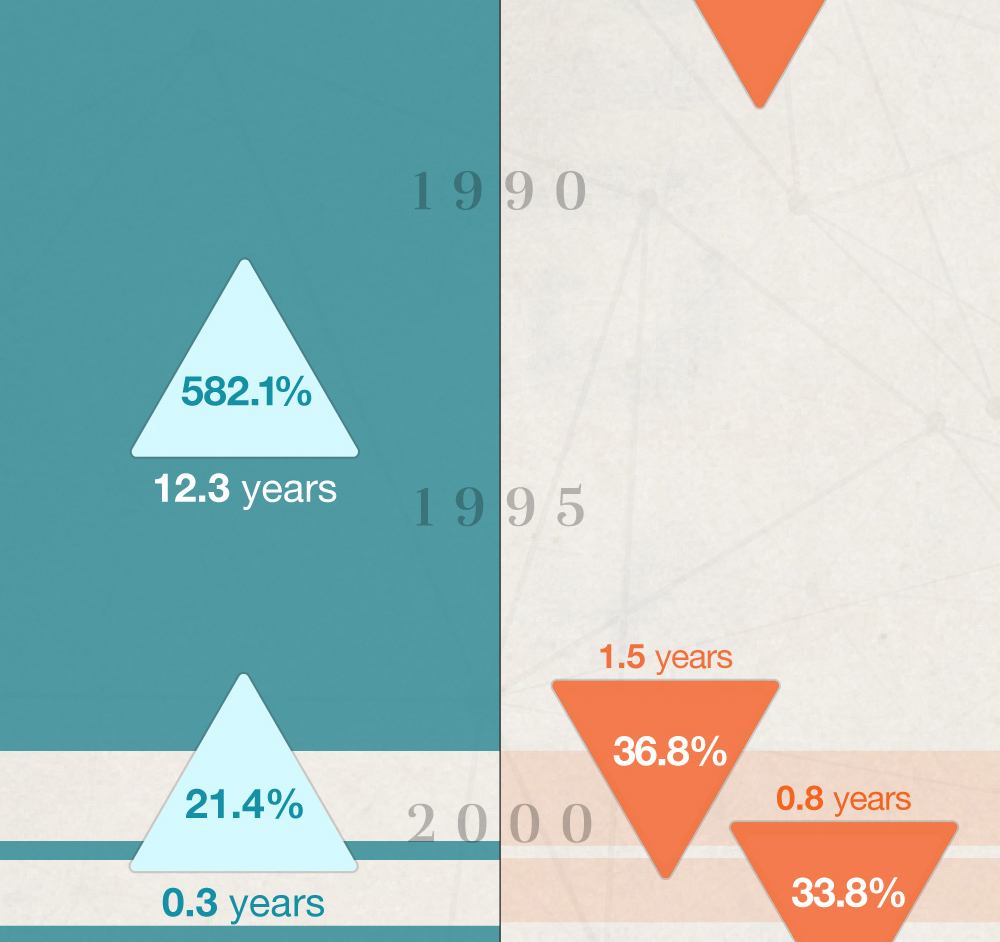

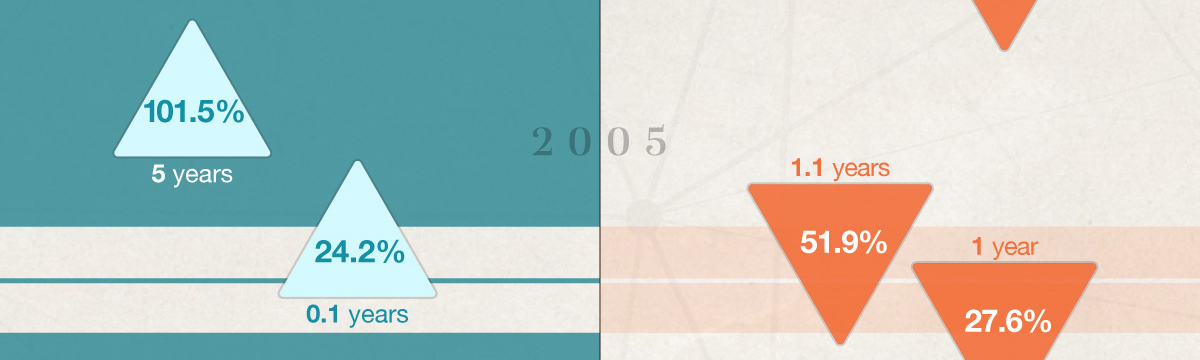

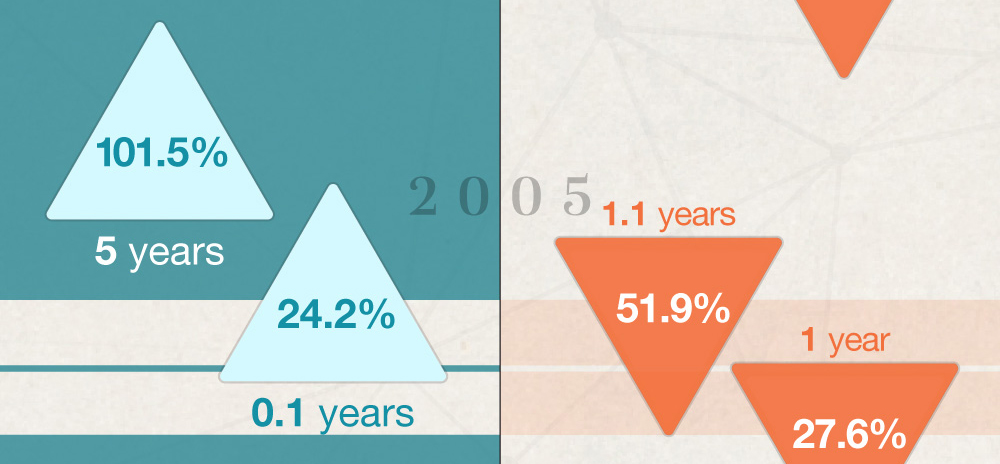

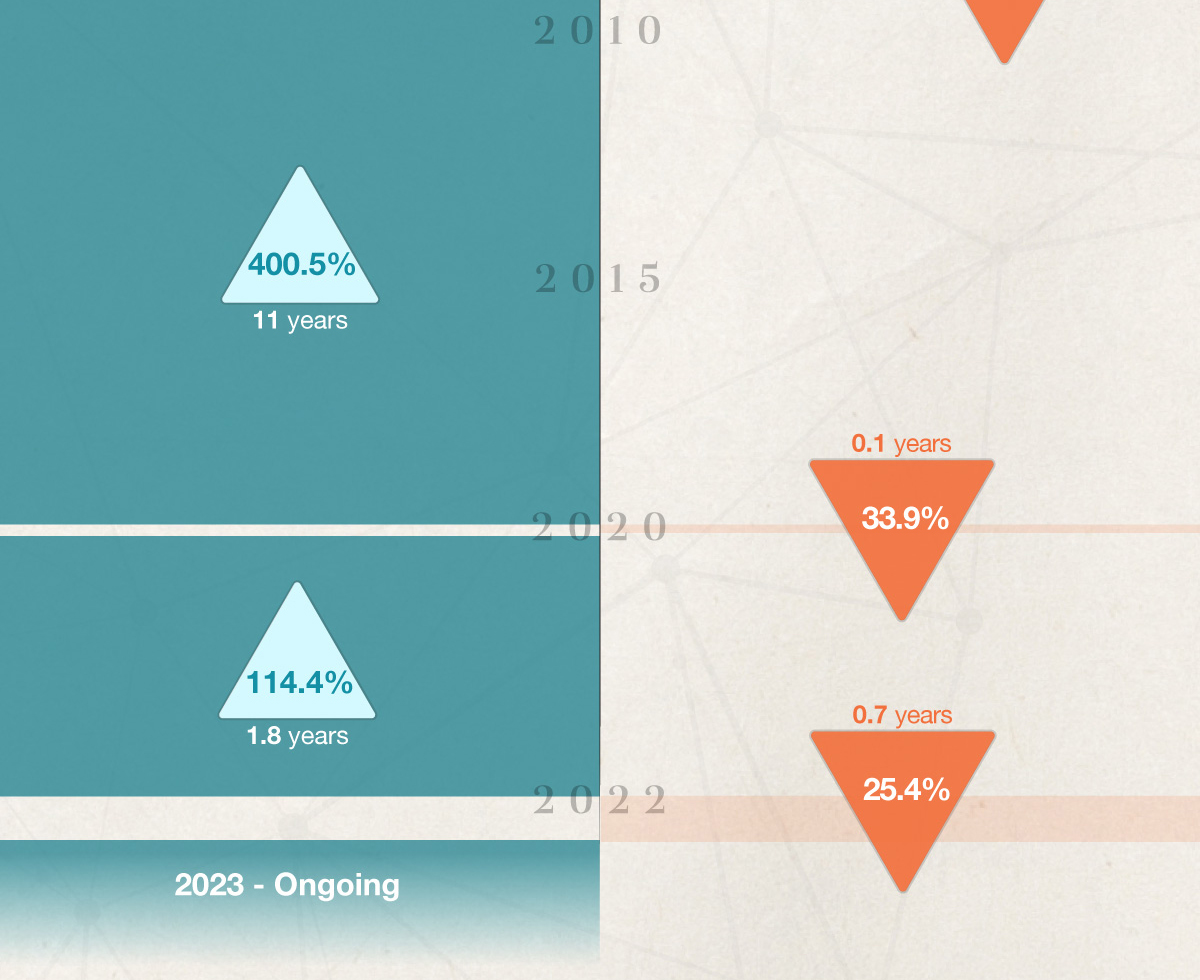

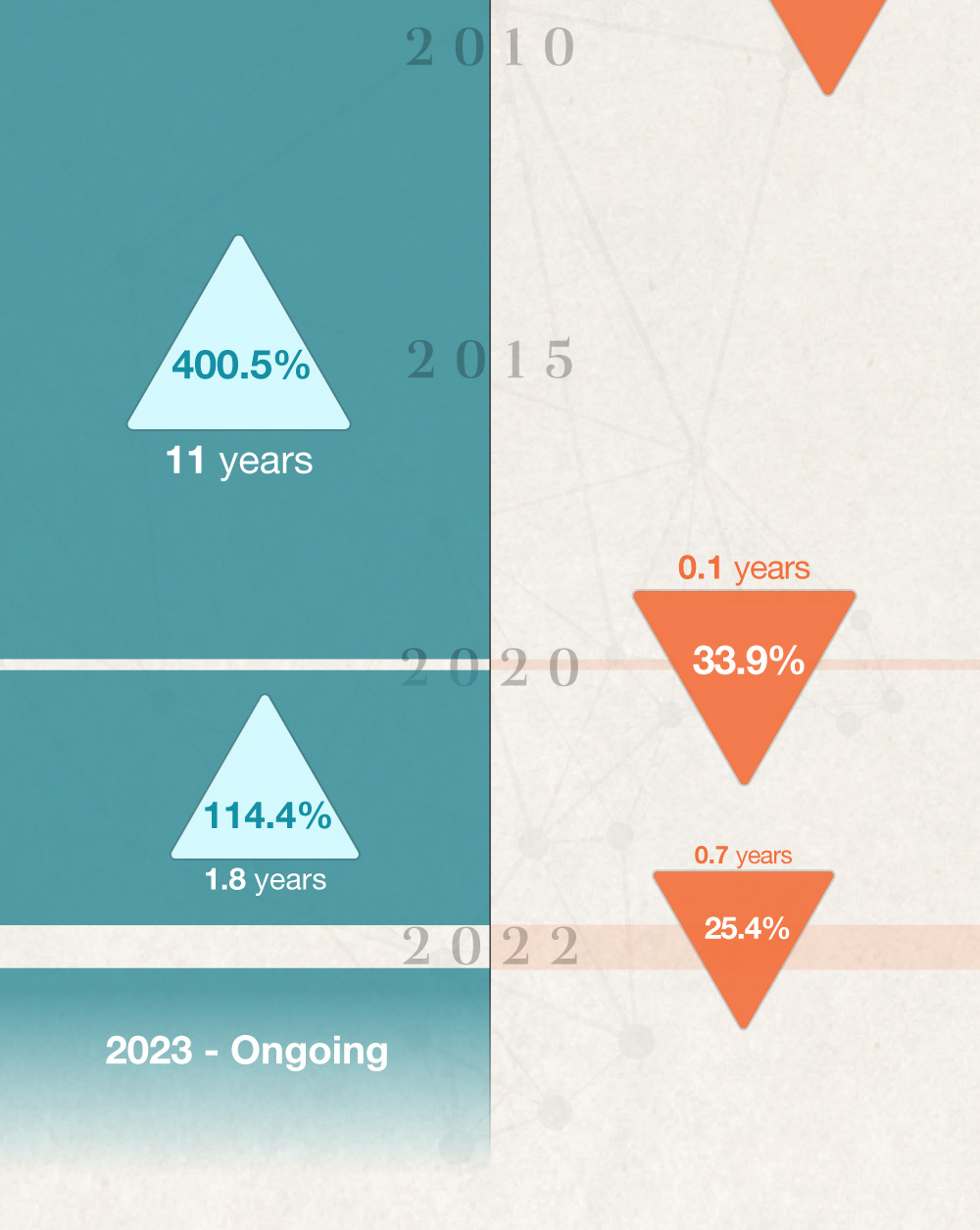

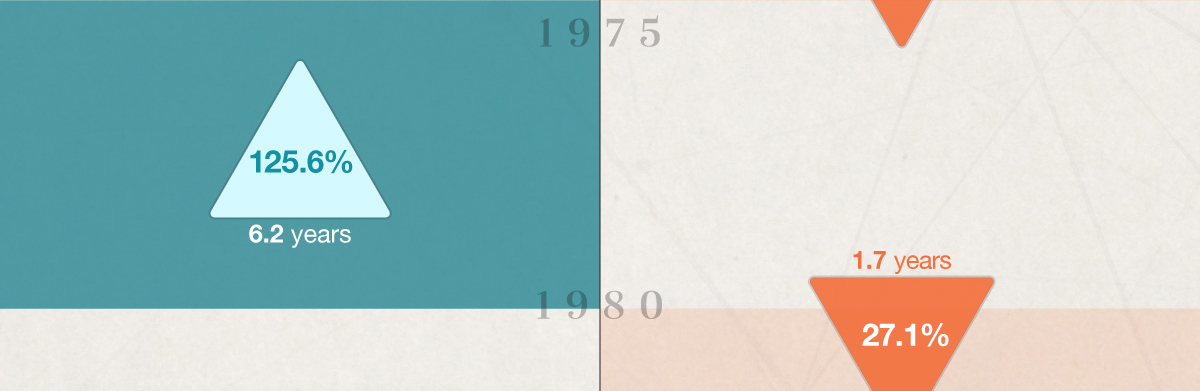

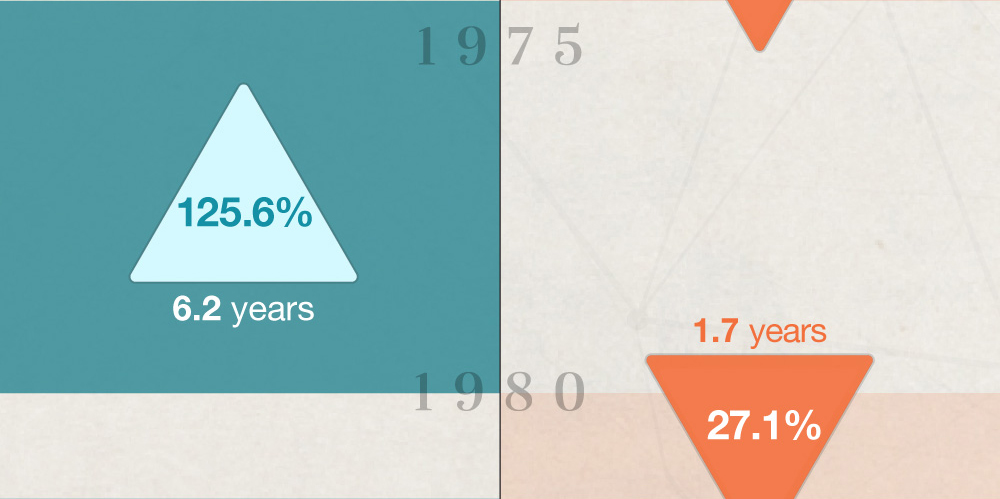

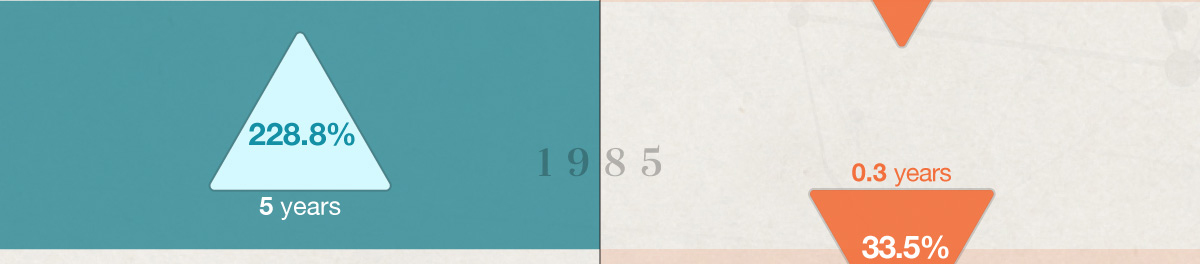

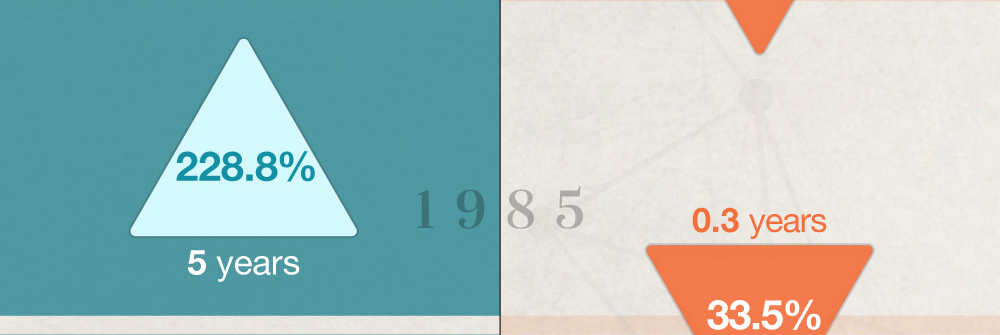

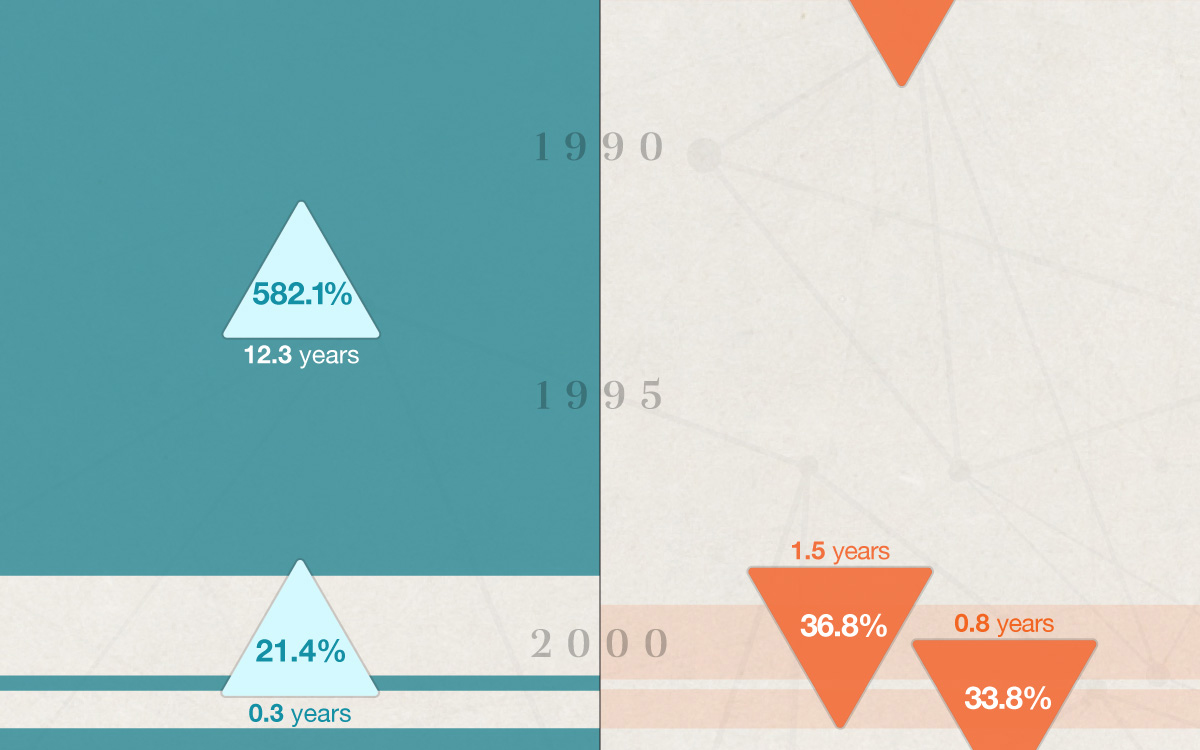

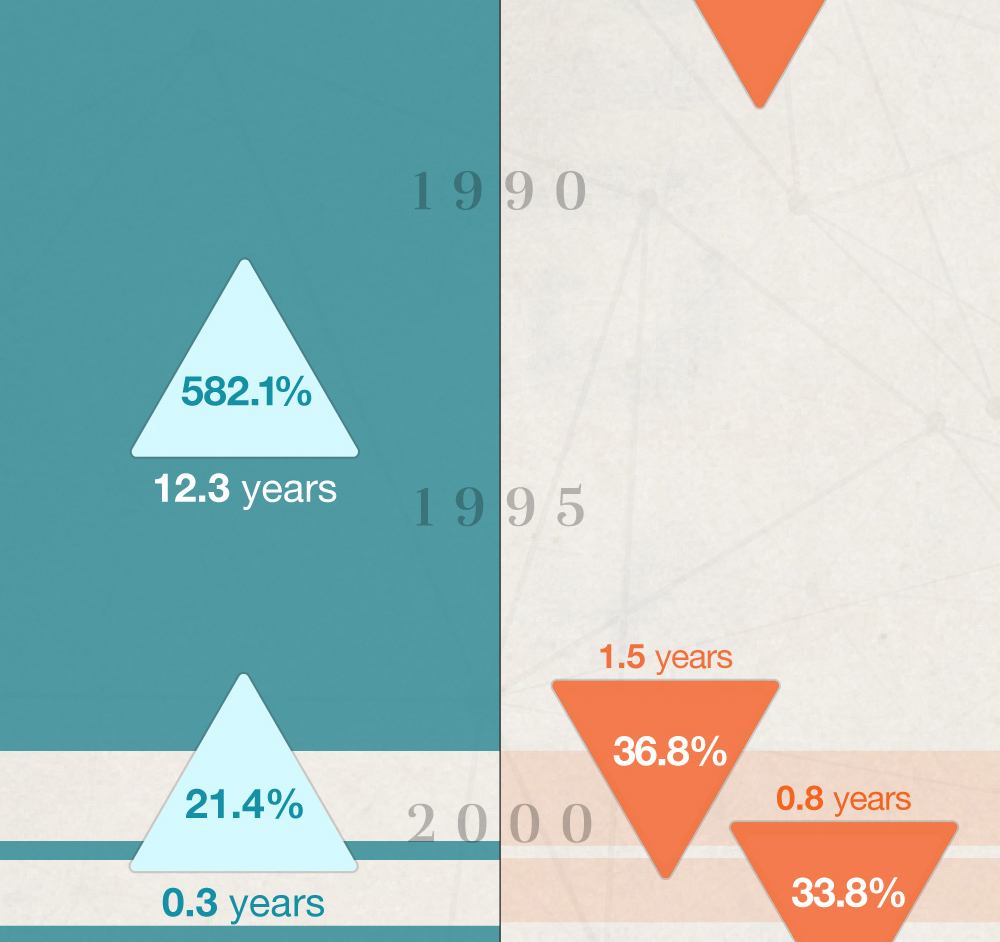

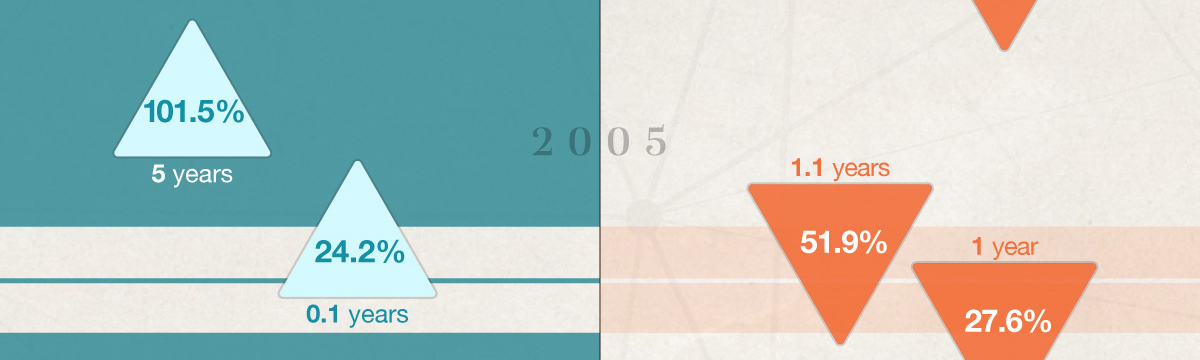

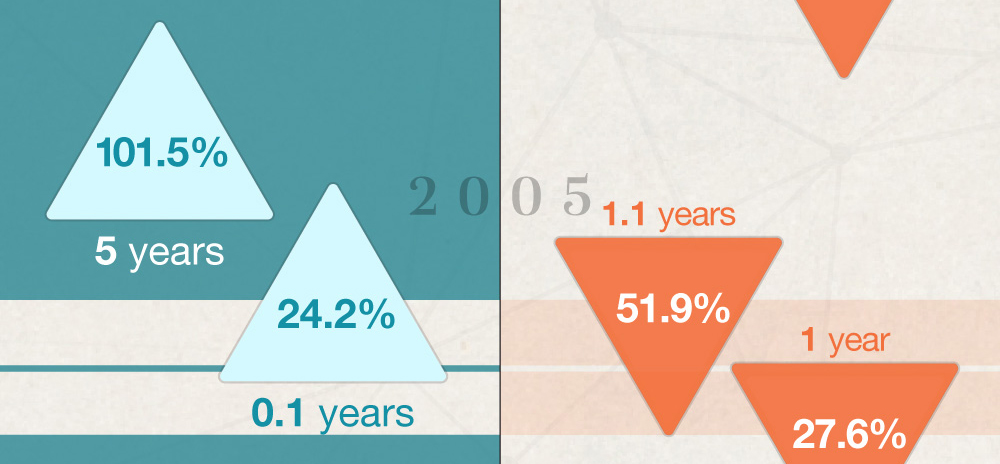

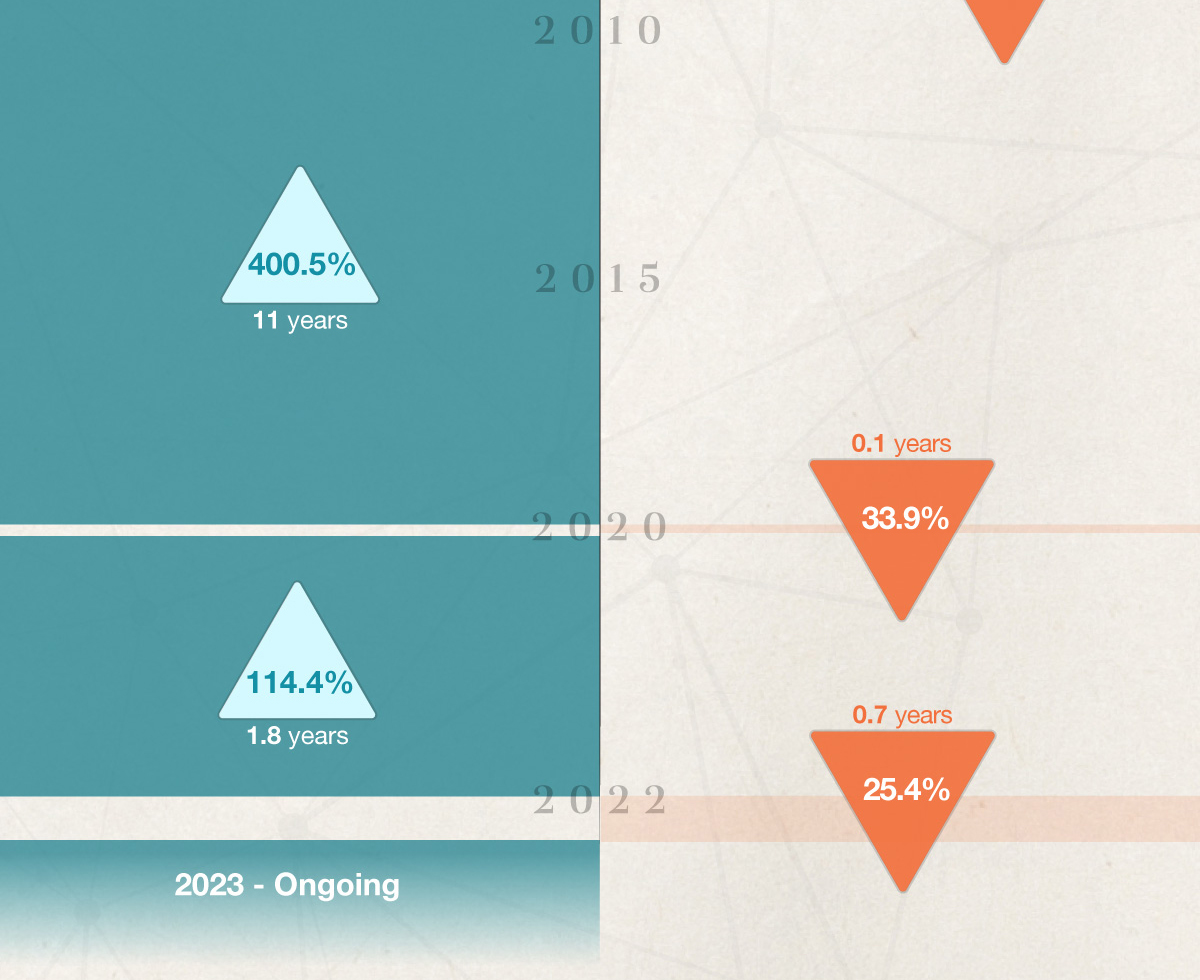

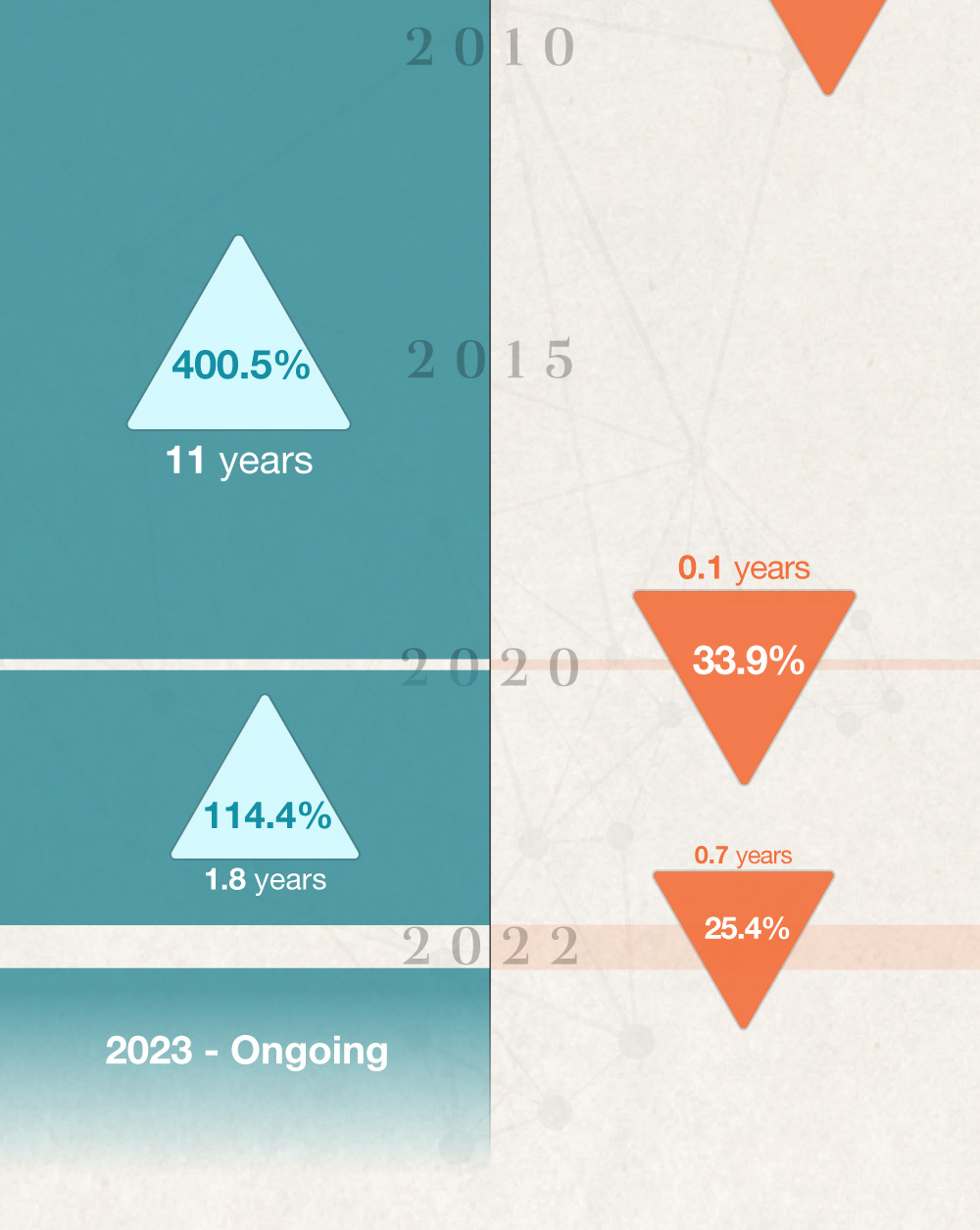

Bull & Bear Markets: A Timeline

October 2, 1951 – November 27, 2020

In this article, explore the benefits of the Federal Student Grant Program.

Here's one strategy that combines two different annuities to generate income and rebuild principal.

Help small businesses make better retirement decisions for employees with this eye-catching and informative infographic.